We're all about bonds

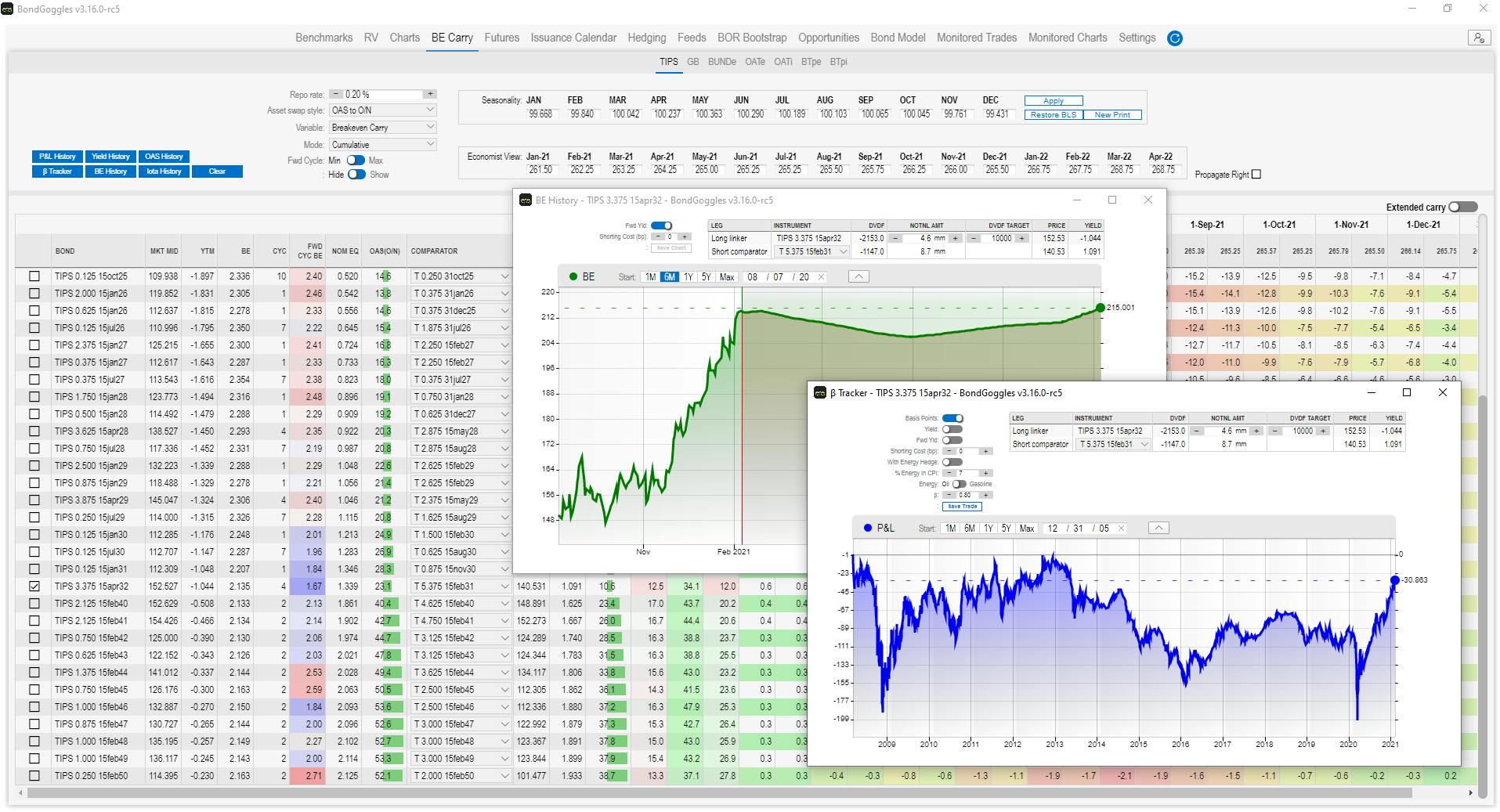

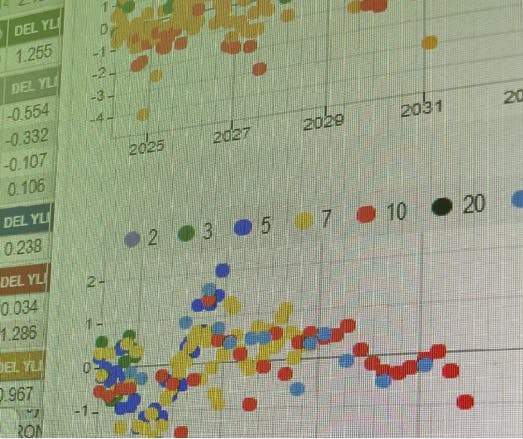

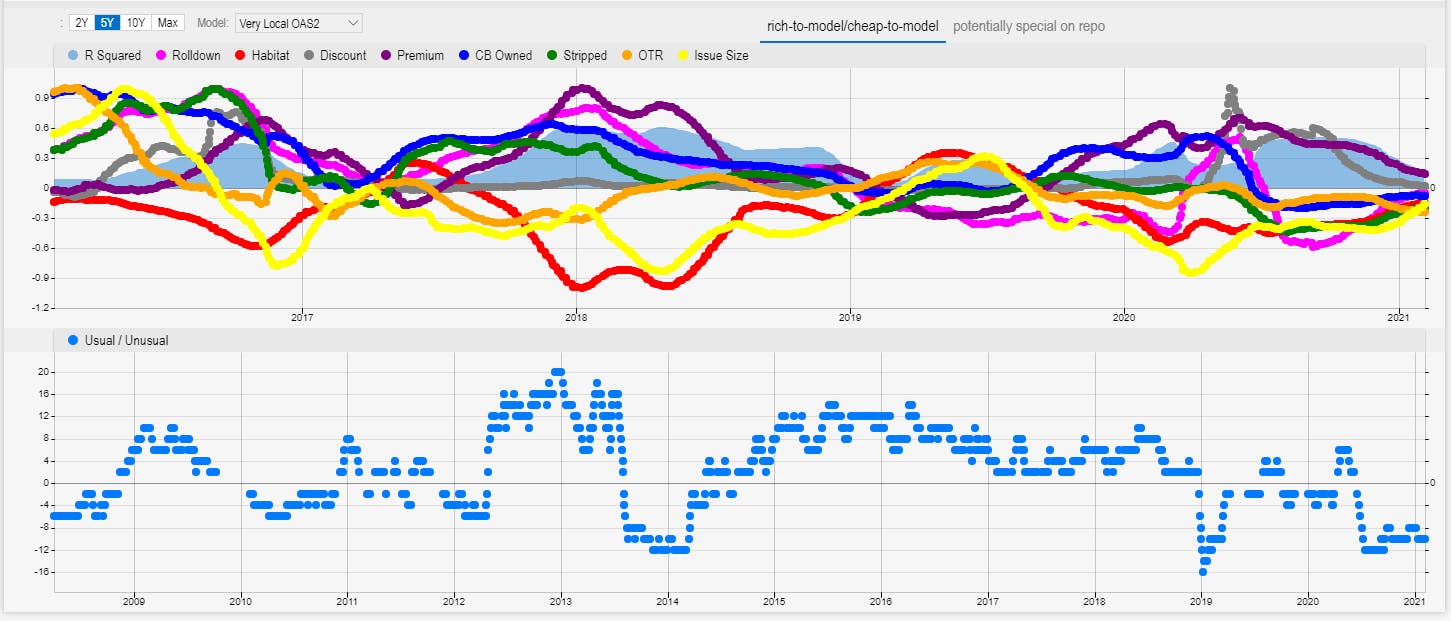

If you need better analytics than your dealer, you've come to the right place: our algorithms will help you pick the best bond trades.

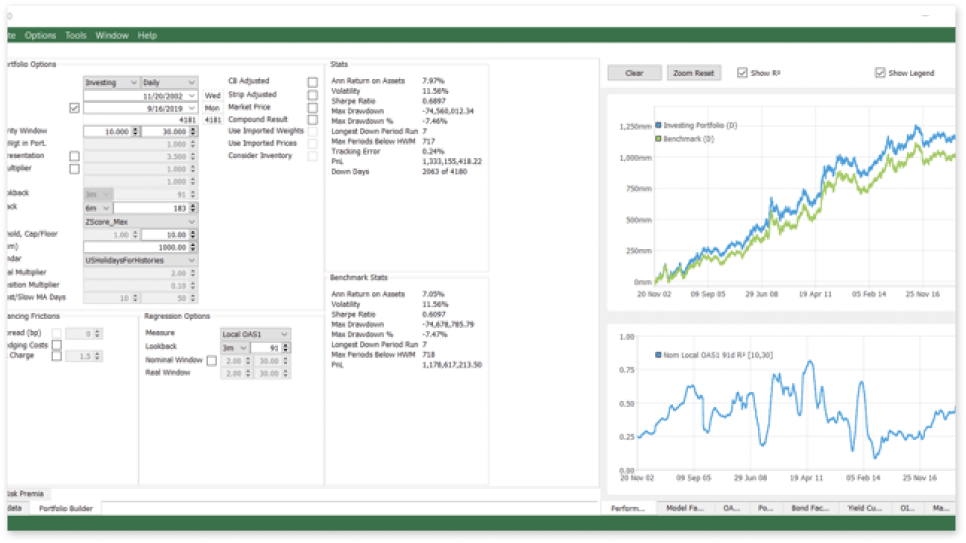

If it's a government bond ETF you want to build, we'll help you craft an algorithmic strategy, backtest it and execute it.

If you want to prototype it all on spreadsheet, we've got the addins you'll need.

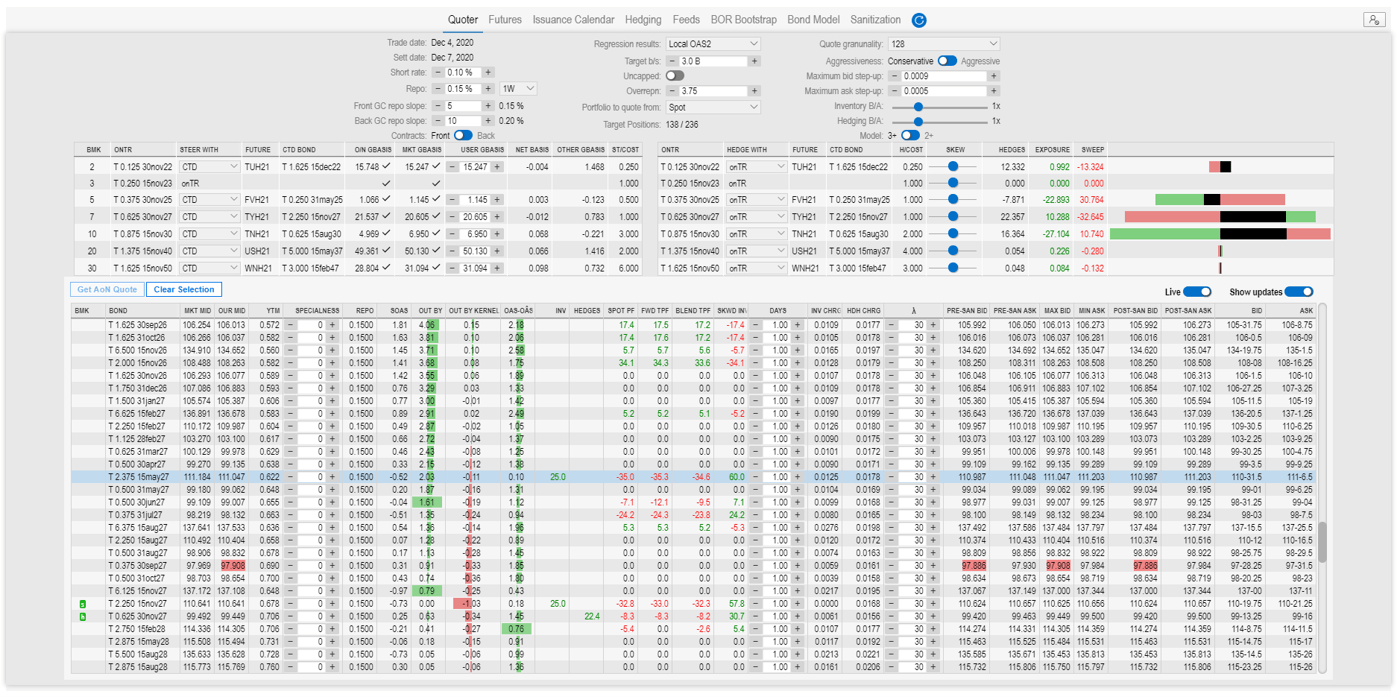

And if you want to make markets in government bonds, ours is the only software on the market that can do that too. Algorithmically, of course. Contact us and we'll tell you how.